Item 5, a building contractor in Austin, Texas, doesn’t require its clients to salvage materials from renovations and demolitions beyond the city of Austin requirements. But Chris Sebilia, its construction director, said clients are more likely to deconstruct a project and divert the materials from the landfill when he does one simple thing—offers it as an option.

By reusing and recycling, the firm has been able to keep as much as 85% of waste from individual projects out of landfills. Sometimes all clients need is a little extra education, Sebilia said. “We’ve actually even had some clients who we didn’t expect to go for that option go for that option.”

What to do with waste from construction and demolition projects is a significant global problem. In the United States, 600 million tons of debris were generated in 2018, more than twice the amount of municipal solid waste produced that year, according to the U.S. Environmental Protection Agency. In the European Union, C&D waste was the largest waste stream in terms of mass, totaling 374 million tons in 2016, according to the European Environment Agency.

But the tides are shifting, and the market for C&D waste recycling is growing. A May 2023 report from Allied Market Research forecasted it to grow from $127 million in 2019 to $149 million in 2027.

Curious why 3 million AECO professionals worldwide use Bluebeam to finish projects faster?

Still, even as the market grows, transforming the industry into a space where every client and contractor embraces deconstruction, reuse and recycling will take work. Contractors like Item 5 and groups like All For Reuse are wading into long-held objections with education, opportunities and action. All For Reuse is developing a network of building professionals who are committed to the reuse of commercial building materials.

“We are simultaneously both running a business and building a market at the same time,” said Andrew Ellsworth, part of All For Reuse’s leadership team and CEO and founder of Doors Unhinged, which sells reclaimed commercial door systems. “So, we have to do a lot of customer education.”

Realities on the ground

Increasing consumer interest and government environmental regulations, along with a rising demand for recycled materials and advancements in recycling technologies, are behind the burgeoning interest in reuse and recycling, the Allied Market Research report found.

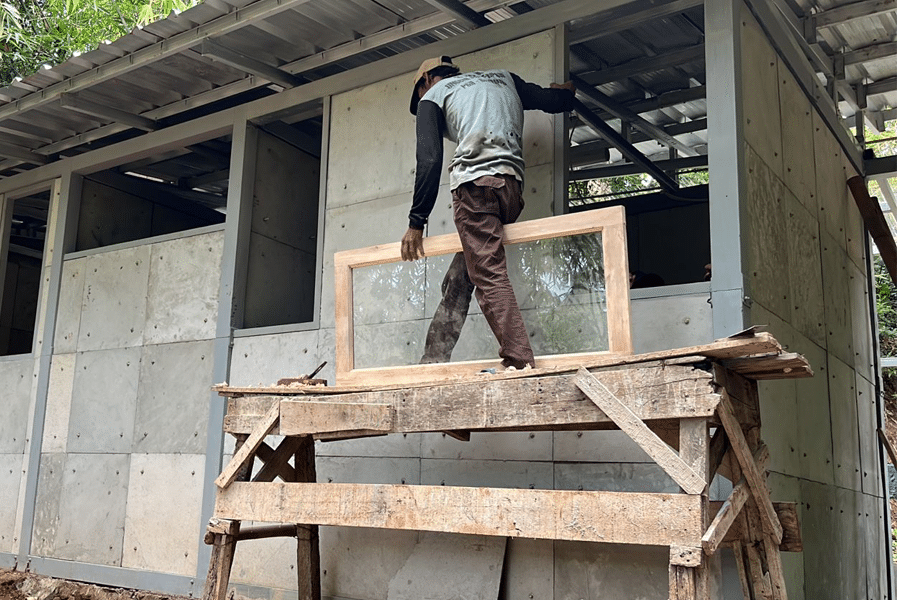

But on the ground, in the day-to-day work to renovate an office building or tear down a home, contractors and construction teams face plenty of challenges to salvaging and reuse.

In a sector that runs on tight profit margins and deadlines, not everybody is on board with the extra time or cost required to carefully deconstruct a project. A Portland State University study on the economics of residential building deconstruction found that the demolition of a single-family home takes two days and costs about $10,300. A deconstruction of the same house would take 10 to 15 business days and cost $18,800.

But Sebilia said he’s been “blown away” by how fast some projects can be salvaged. A full kitchen, for example, might just take a few extra days. And he points out, salvaged materials that are donated can turn into tax deductions for owners. One received a $25,000 tax deduction after 1980s-era materials from a single-family home were donated, he said.

What’s more, building a circular economy in construction where used materials are funneled back into new projects and not the landfill is a work in progress.

Contractors aren’t always set up to store the materials they pull from buildings, and it’s often not easy to find places that take every salvaged material or a market to purchase the items when needed. Some architects, project owners and contractors also are leery of reusing materials, worried about the quality or appearance, Ellsworth said.

Supply and demand

With Doors Unhinged, Ellsworth is working to provide an example of what the construction material reuse market could become. The company collects used commercial doors, refurbishes them and has a warehouse of high-quality doors for projects.

The goal is to serve the industry in the way it needs to be served, Ellsworth said. And that’s not through a series of one-off building material reuse centers, which might have only a dozen mismatched doors for a project that needs 300.

Instead, the sector would be better served with specialized suppliers of salvaged building materials across the country that can provide every door or light fixture or tile that a project requires, Ellsworth said. Building that chain of suppliers, however, requires customers who are interested in giving used materials a second life.

“We have the opposite problem that reuse centers have where they have a strong customer base, but often lack good, consistent access to material,” Ellsworth said. “What we need is demand development.”

To build that demand, big corporations with sustainability goals, universities and government agencies are the answer, Ellsworth said. These large portfolio owners, he said, can make an “outsized difference” in the work to convince others that salvaged materials aren’t trash.

Ellsworth is also working with All For Reuse on broader efforts to advocate, encourage and formalize the salvaging and reuse of construction materials. The aim through various avenues is to build a “patient and lasting demand” for the materials, he said. Supporters of All For Reuse’s pledge to locate deconstruction and reuse partners, consider using reclaimed materials and create an infrastructure to facilitate reuse includes Google and JLL.

“We have a lot of social capital, and we’ve gotten some attention,” Ellsworth said of All For Reuse. “What I want is to parlay this into coordinated and strategic action.”

Eager for options

In Austin, Sebilia sees reason for hope. “When you’re seeing dumpsters and dumpsters of material leave your jobsite, it’s hard to miss that you’re contributing and not be aware of where it’s going and what’s happening to that,” he said.

There are growing opportunities to do better, thanks to interest from clients and the availability of vendors, such as those selling lumber from sustainable forests. “As more vendors come on to sell, we will take more advantage of buying it,” Sebilia said. “From my point of view, we’d love to have the option to buy more of these things and from local places.”

Ellsworth is hopeful, too. The buzz around deconstruction and reuse is growing, he said. “It’s turning into something that’s more substantial and bigger than us, and that’s always been my goal.”